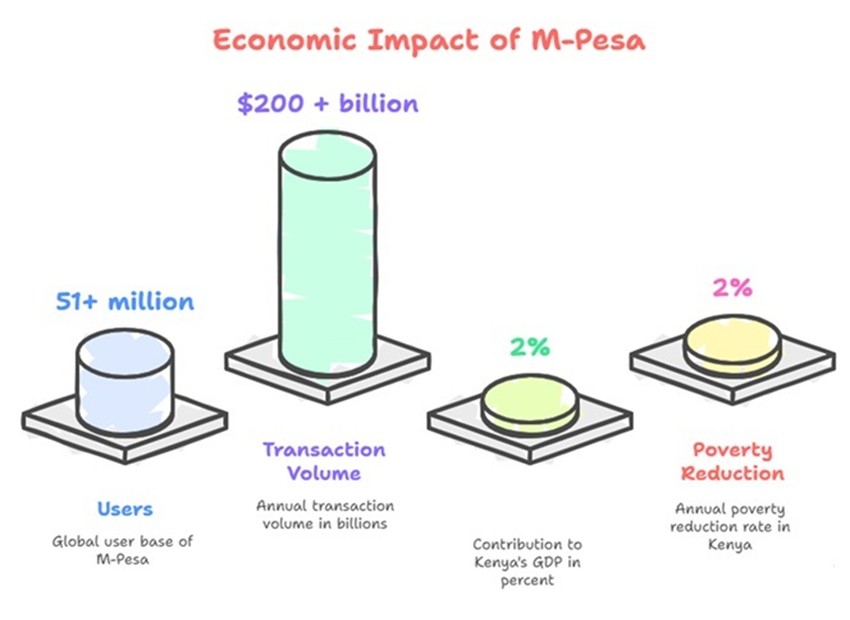

Mobile Money: How M-Pesa Transformed Financial Inclusion?

"M-Pesa didn’t just change money transfers—it redefined financial infrastructure."

The Economist -Prestigious weekly international publication (in magazine format) in 2007 at Kenya by "Safaricom" (a Vodafone subsidiary), it has since expanded to multiple countries, redefining mobile banking.

"M-Pesa" has emerged as a global benchmark in digital financial services, transforming financial inclusion—particularly in emerging markets.

Features & Technology:

1. Lightweight Infrastructure:

- Operates via " mobile networks" without requiring traditional bank accounts

- Supports "USSD-based transactions" (Unstructured Supplementary Service Data) is a real-time, session-based mobile.

2. Advanced Security:

- End-to-end encryption

- Multi-factor authentication

3. Comprehensive Services:

- Instant money transfers

- Bill payments

- Microloans & savings

- Merchant payments

Challenges & Solutions:

- Regulatory Compliance: Partnering with central banks to establish fintech frameworks

- Cybersecurity: AI-powered fraud detection systems

- Financial Literacy: Rural user education programs

Success Factors:

- Ease of Use: The system relies on a simple and user-friendly interface via SMS, making it accessible to all segments of society, regardless of their education level or technical expertise.

- Widespread Mobile Phone Penetration: M-Pesa capitalized on the massive adoption of mobile phones in the markets where it operated, enabling access to a broad segment of the unbanked population.

- Integration with Other Services: M-Pesa successfully integrated with numerous other services, such as utility companies and merchants, making it an essential part of users' daily lives.

- Agent Network: The system employed an extensive network of agents spread across the country, facilitating cash deposits and withdrawals for users.

- Continuous Innovation: M-Pesa did not stop at basic transfer services but continued to evolve and add new services to meet the changing needs of users.

M-Pesa demonstrates how streamlined digital solutions can catalyze financial inclusion. As blockchain and central bank digital currencies (CBDCs) emerge, M-Pesa continues to shape the evolution of digital payment ecosystems.

Farhan Hassan Al Shammari

X: https://twitter.com/farhan_939

E-mail: fhshasn@gmail.com